Sage Payroll

Sage Payroll provides automated, compliant payroll processing ideal for small businesses. It handles employee payments, statutory deductions, UIF/PAYE compliance, time tracking, and integrates seamlessly with Sage Accounting.

Pros

- Excellent tax & compliance support (PAYE, UIF, SDL)

- Integration with Sage Accounting

- Good automation for recurring payroll runs

- Employee self-service portal available

Cons

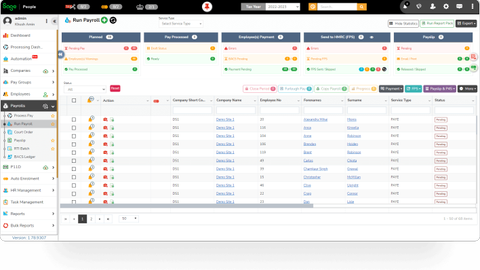

- Interface is less modern than some competitors

- Advanced HR features require higher tiers

- Can feel complex for first-time payroll users

Key Ratings

Features score: 4.4

Pricing score: 4.1

Support score: 3.9

Compliance score: 4.7

Visit SageWhat is Sage Payroll?

Sage Payroll is a cloud-based payroll management system designed to help businesses pay employees accurately and stay compliant with local tax regulations. It automates calculations for PAYE, UIF, SDL, leave balances, and more.

Is Sage Payroll Legit?

Yes — Sage is one of the most trusted payroll providers globally, with millions of users across various regions. Sage Payroll is compliant with South African, UK, and other international payroll standards.

Visit Sage

Visit Sage

Sage Payroll Pricing (Example)

Pricing varies by region and number of employees. Below is an example — always check Sage’s local site for exact prices.

| Plan | Price | What’s Included |

|---|---|---|

| Basic Payroll | From $10–$20 / month | Payroll runs, tax calculations, payslips |

| Standard Payroll | From $20–$35 / month | Leave management, reporting, employee self-service |

| Advanced Payroll | $35+ / month | Advanced HR tools, integrations & automation |

What’s Included in Sage Payroll?

Sage Payroll includes everything required to run payroll efficiently and stay compliant — including tax calculations, payslip generation, employee records, and leave tracking.

Sage Payroll Features

| Feature | Description |

|---|---|

| Automated Payroll Runs | Process monthly, weekly, or bi-weekly payroll automatically. |

| Tax & Compliance | PAYE, UIF, SDL, and IRP5 reporting for supported regions. |

| Leave Management | Track leave balances, requests, and employee records. |

| Employee Self-Service | Employees access payslips and update personal information. |

| Accounting Integration | Seamless sync with Sage Accounting for expense posting. |

| Reporting | Generate payroll summaries, tax reports, and analytics. |

Notable Features

- Strong payroll compliance for regional tax laws

- Automated payroll cycles to reduce admin

- Employee portal for better HR efficiency

- Integration with Sage Accounting for instant posting

Sage Support Offering

Sage offers tutorials, help articles, payroll compliance guides, and support via chat, phone, and community forums.

User Review Highlights

- Accuracy: Very reliable for tax calculations

- Compliance: Especially strong in regulated markets

- Value: Good for small and medium businesses

- User Experience: Functional but not the most modern UI

How Sage Payroll Compares to Competitors

| Feature | Sage Payroll | QuickBooks Payroll | Gusto |

|---|---|---|---|

| Compliance | ★★★★★ | ★★★★☆ | ★★★☆☆ |

| Ease of Use | ★★★★☆ | ★★★★★ | ★★★★★ |

| Integration | ★★★★★ | ★★★★☆ | ★★★☆☆ |

| Best For | SMBs needing strong compliance | US-based small businesses | Freelancers & start-ups |