Sage Accounting

Sage Accounting (part of Sage Business Cloud) is a trusted accounting solution tailored to small and growing businesses. It provides invoicing, VAT and tax-support features, cash flow tools, bank feeds, and payroll integration for supported regions.

Pros

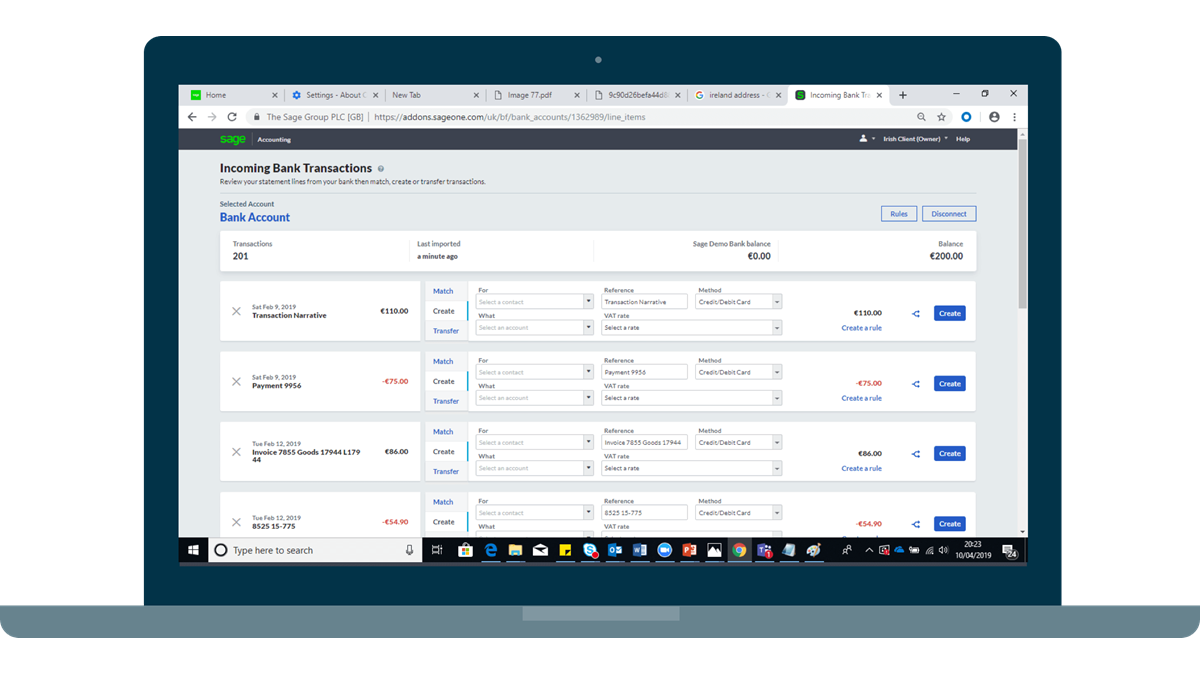

- Strong UK & international tax support

- Good bank feed and reconciliation tools

- Scalable — integrates with payroll and payments

- Clear reporting and VAT returns

Cons

- Some advanced features behind higher tiers

- Interface can feel dated compared to newer rivals

- Customer support quality varies by region

Key Ratings

Features score: 4.3

Pricing score: 4

Support score: 3.8

Reputation score: 4.2

Visit WebsiteWhat is Sage Accounting?

Sage Accounting is part of the Sage Business Cloud family, focused on helping small businesses manage bookkeeping, VAT, invoicing, and basic payroll workflows. It suits sole traders and SMEs who need dependable compliance features and straightforward reporting.

Is Sage Accounting Legit?

Yes — Sage is an established brand with decades in accounting software. Sage Accounting is used by tens of thousands of small businesses worldwide and offers region-specific compliance such as Making Tax Digital (UK) and VAT filings in supported countries.

Visit Sage

Visit Sage

Sage Accounting Pricing (Example)

Sage offers tiered plans that vary by features, users and region. Below is a representative example — always check Sage’s local site for exact pricing in your country.

| Plan | Price | What’s Included |

|---|---|---|

| Starter | From $0–$12 / month | Basic invoicing, expenses, and bank connections |

| Standard | From $12–$25 / month | Unlimited invoices, VAT returns, reporting |

| Premium | From $25+ / month | Multi-user, advanced reporting, payroll add-on |

What Is Included in Sage Plans?

Sage’s plans typically include invoicing, bank reconciliation, VAT and tax tools, expense tracking, and reporting. Higher tiers unlock more users, advanced reports, and integrations with payroll, payments, and third-party apps.

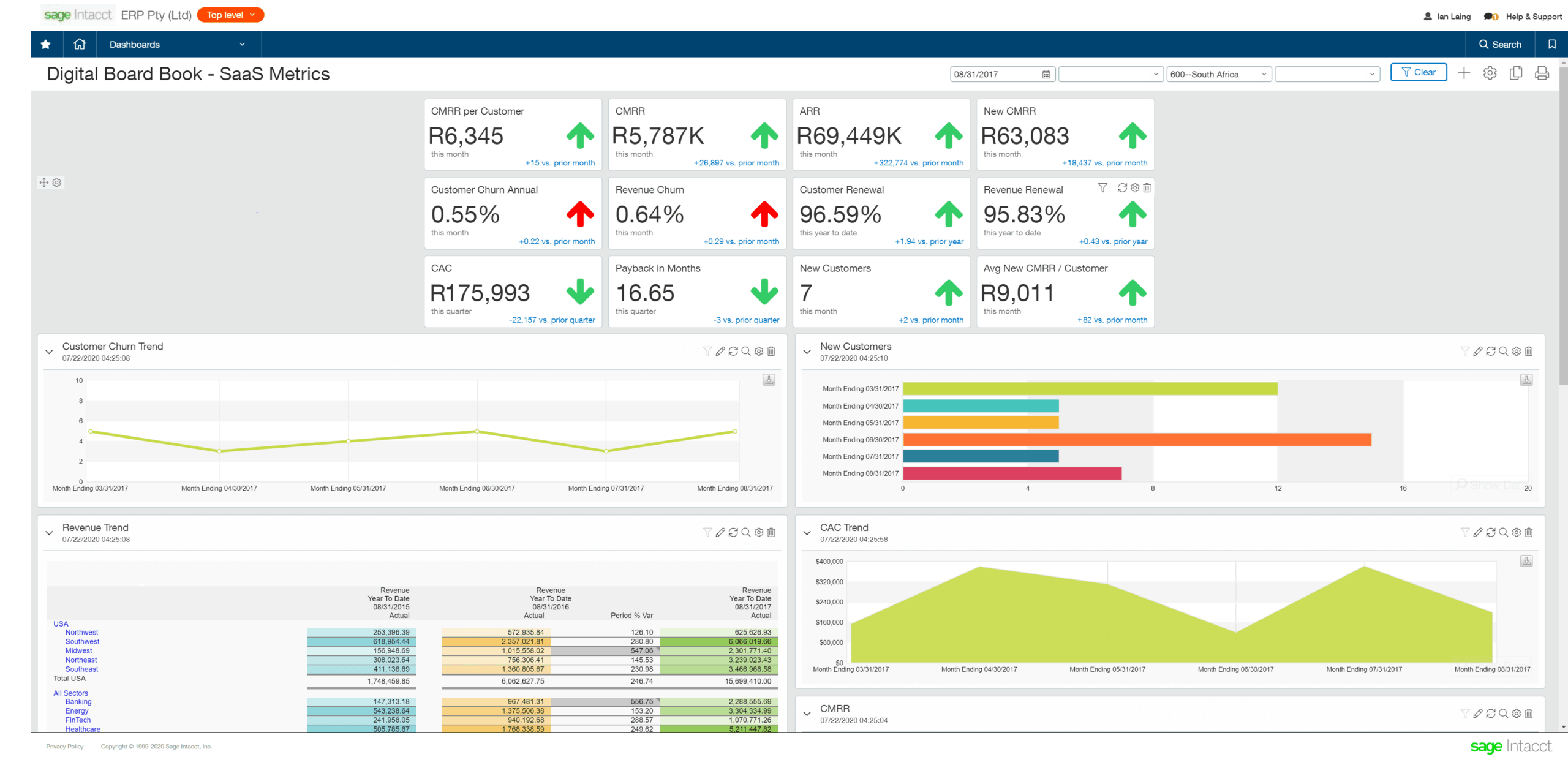

Sage Accounting Features

| Feature | Description |

|---|---|

| Invoicing | Create, send, and automate recurring invoices with payment links. |

| Bank Feeds & Reconciliation | Link bank accounts for automatic transaction import and matching. |

| VAT & Tax Support | Prepare and submit VAT/returns where supported by local legislation. |

| Expenses | Record supplier bills, receipts, and manage payables. |

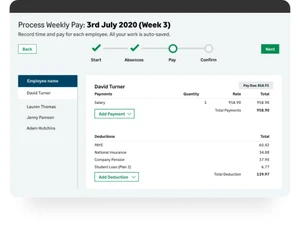

| Payroll Integration | Connect to Sage payroll modules in supported regions. |

| Reporting | Standard P&L, balance sheet, cash flow and custom reports. |

| Mobile App | Basic mobile features for invoicing and expense capture. |

Notable Features

- Strong compliance & tax tools for many markets

- Payroll & payments integrations to reduce manual work

- Bank feed reconciliation that speeds up bookkeeping

- Scalable options as businesses grow

Sage Support Offering

Sage provides help articles, community forums, and region-based support channels. Many features are documented extensively; paid plans typically get faster support options.

User Review Highlights

- Reliability: Trusted and stable for bookkeeping tasks

- Compliance: Good for VAT and tax filing where supported

- Value: Competitive when bundled with payroll/payments

- User Experience: Functional but not the most modern UI

How Sage Compares to Other Platforms

| Feature | Sage | QuickBooks | Xero |

|---|---|---|---|

| Ease of Use | ★★★★☆ | ★★★★☆ | ★★★★★ |

| Pricing | $$ | $$$ | $$ |

| Compliance | ★★★★★ | ★★★★☆ | ★★★★☆ |

| Best For | SMBs needing strong tax support | Growing US-focused businesses | Small businesses & accountants |