QuickBooks Payroll

QuickBooks Payroll is a fully integrated payroll solution designed for small to midsize businesses. It handles employee payments, tax calculations, submissions, leave management, and integrates seamlessly with QuickBooks Online.

Pros

- Strong integration with QuickBooks Online

- Automated payroll tax calculations

- Easy employee self-service portal

- Fast direct deposit options (same-day in some regions)

Cons

- Pricing varies by region and tier

- Limited advanced HR tools without add-ons

- Support response time can be slow during peak periods

Key Ratings

Features score: 4.5

Pricing score: 3.9

Support score: 4.0

Compliance score: 4.4

Visit WebsiteWhat is QuickBooks Payroll?

QuickBooks Payroll automates employee payments, tax filings, benefits, and compliance reporting. It integrates directly with QuickBooks Online, making it ideal for small businesses that want unified accounting and payroll.

Is QuickBooks Payroll Legit?

Yes — QuickBooks Payroll is widely used in the US, UK, South Africa, Australia, and other regions. It is known for reliable tax compliance and seamless integration with QuickBooks’ ecosystem.

QuickBooks Payroll Pricing (Example)

Pricing varies by region. Below is a generalized example — always check your country’s QuickBooks website for exact figures.

| Plan | Price | What’s Included |

|---|---|---|

| Core | From $22–$45 / month + per-employee fee | Basic payroll, tax calculations, full-service filings |

| Premium | From $45–$75 / month | Same-day deposits, HR support, time tracking |

| Elite | $75+ / month | Tax penalty protection, deep HR tools, project costing |

QuickBooks Payroll Features

| Feature | Description |

|---|---|

| Automated Payroll | Automatically calculates wages, taxes, and deductions. |

| Tax Filing | Handles payroll tax submissions in supported countries. |

| Time Tracking | Track hours and sync directly into payroll (Premium+). |

| Employee Self-Service | Employees can download payslips and update info. |

| Benefits & Leave | Manage PTO, benefits, leave balances, and approvals. |

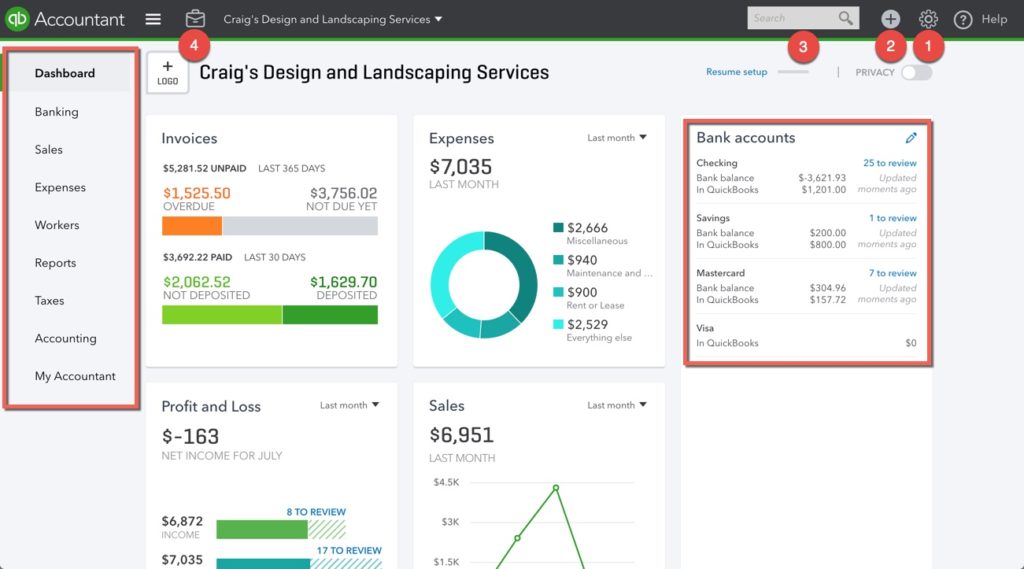

| Integration | Native syncing with QuickBooks Online for reporting. |

Why Businesses Choose QuickBooks Payroll

- Excellent automation for payroll and tax flows

- Strong compliance tools in supported jurisdictions

- Seamless syncing with QuickBooks Online bookkeeping

- Some of the fastest payroll deposit options

QuickBooks Support Offering

QuickBooks offers live chat, phone support, training articles, and community forums. Higher-tier plans receive priority support and more HR assistance.

What Users Like

- Ease of setup: Very beginner-friendly

- Automation: Reduces manual effort significantly

- Integration: Perfect for existing QuickBooks users

- Compliance: Strong tax handling

How QuickBooks Payroll Compares

| Feature | QuickBooks | Sage Payroll | Xero Payroll |

|---|---|---|---|

| Ease of Use | ★★★★★ | ★★★★☆ | ★★★★☆ |

| Automation | ★★★★★ | ★★★★☆ | ★★★☆☆ |

| Pricing | $$$ | $$ | $$ |

| Best For | Businesses using QuickBooks Online | SMEs needing solid compliance | Small teams with simple payroll |